- Home

- Credits & Exemptions

- Intent to Cut & Excavation

Purpose:

The Assessing Department is responsible for:

- Taxable properties

- Revaluations

- Appeals

- Exemptions

- Deferrals

- Abatements

- Credits

- Maintaining tax cards

- Maintaining Records of Property Transfers

- Preparation of tax maps

The Assessing functions are performed by the Assessing Clerk, the professional Assessors and the Board of Selectmen.

In addition, the Clerk for Assessing processes timber intent to cut and excavation permits, calculates timber tax and excavation tax; and prepares invoices.

People often ask why the second tax bill is so much higher than the first bill. The first tax bill is an estimate based on last year's budget and tax base. The actual rate is not set until November of every year. The Town doesn't receive the amount to be raised by taxes for the County, State and the school until November. Your first bill is usually lower because of that timing. The second bill has to catch up on all of the increases in six months and is therefore twice the increase as the annual tax increase.

Assessing Office Procedure Regarding Private Property

This Assessing Department policy applies when an inspection of private property is required contractually or by directive of the Board of Selectmen.

If a property is posted “no trespassing” or similar but the property access (i.e., driveway, walkway, etc.) is not obstructed by a gate or other objects such as logs or large boulders, the assessing agent will pass and approach the main door of the building to ask permission to complete the assigned assessing related inspection tasks. (Note: This is the same access that is afforded any person conducting routine business (i.e., meter reader, USPS, FedEx, etc.)).

If the property owner in unavailable or otherwise does not provide permission for such inspection, the assessing agent will promptly leave the property, but may conduct whatever inspection can be conducted from outside of the property boundaries.

In the event the property is posted “no trespassing” or similar and the property access (i.e., driveway, walkway, etc.) is obstructed with either a gate, large logs or large boulders, the assessing agent will not enter the property.

An assessing agent shall only enter private property when it is safe to do so. The presence of any hazard that may pose a risk of harm to the assessing agent is grounds for the assessing agent to refuse entry.

For purposes of this section, a “hazard” includes, but is not limited to, an unrestrained dog or other animal capable of doing bodily harm, a threatening occupier of the property, or ongoing construction, etc.

There are programs created by law to provide property tax credits, exemptions (reduction of the value of taxable property) and deferral of taxes owed. The forms that can be filled out on line using internet explorer for these programs can be found at NH Department of Revenue Administration

A downloadable version of them is available here:

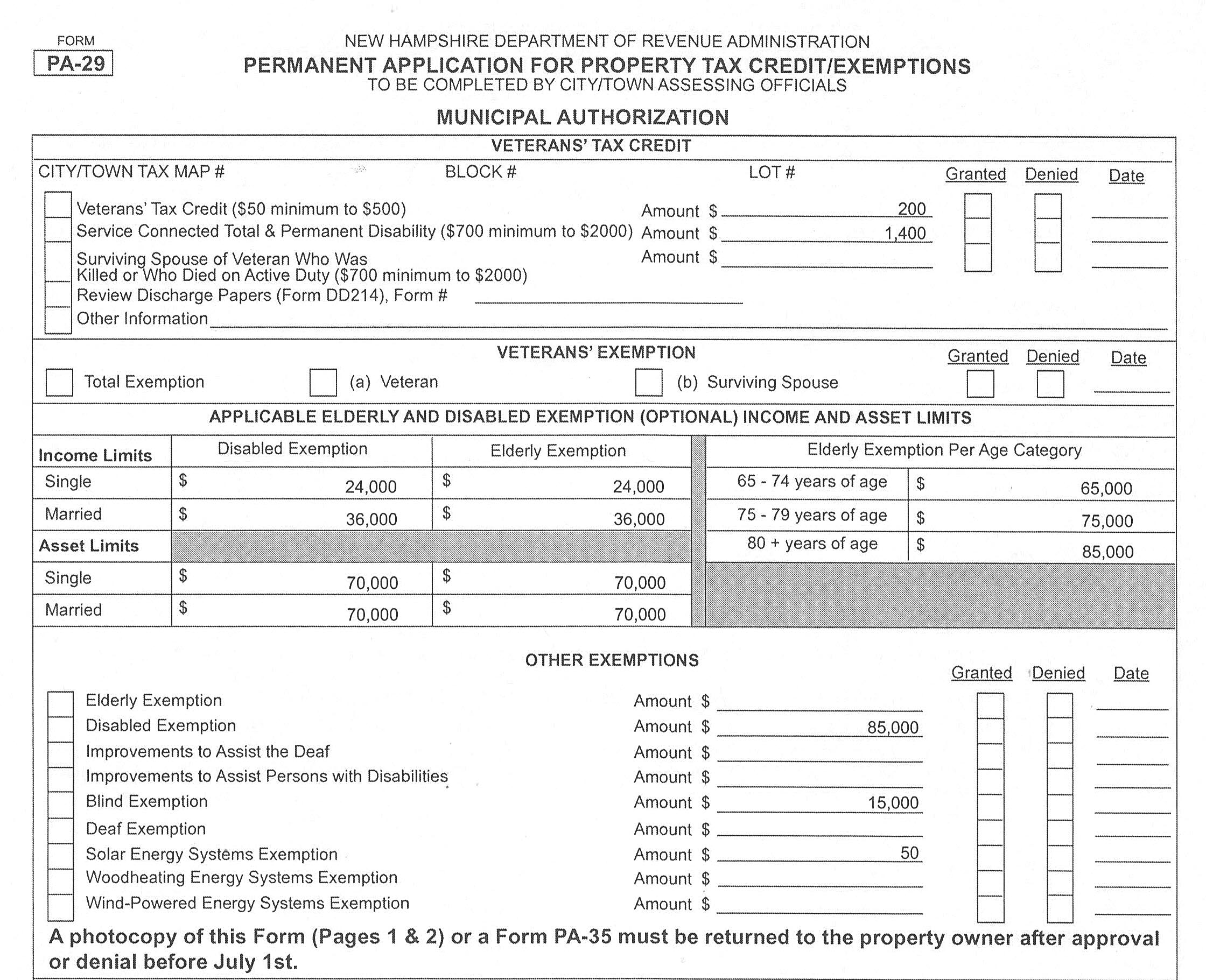

Form PA 29 is used for credits and exemptions and form PA 30 is used for deferrals.

When applying for property tax credits and exemptions, you will need to understand the limitations that apply for each of these programs and these limits will be filled in by the Town.

The limits as approved by the Town voters are shown here:

PDF Version of the Credit Limitations

Downloadable Forms:

To access a form that can be filled out and attached to an email, download the form by right-clicking either on the link or in the open form and saving it on your computer. All files that begin with the letters "PA-" are NH State Forms, and must be opened in Windows Explorer to work. Please switch browsers if necessary.

- PA-29: Credit & Exemptions Limitations Links:

- PA-30: Elderly & Disabled Tax Deferral Application links:

Downloadable Forms:

To access a form that can be filled out and attached to an email, download the form by right-clicking either on the link or in the open form and saving it on your computer. All files that begin with the letters "PA-" are NH State Forms, and must be opened in Windows Explorer to work. Please switch browsers if necessary.

- PA-7:Intent to Cut Links:

- PA-38: Intent to Excavate Links: