- Purpose

- Legal Requirements

- Budget Information

Membership:

The Canaan Budget Committee was established in 1943. The current Committee includes nine members-at-large elected for three year terms. Terms are staggered so that 1/3 of the terms expire each year. Member-at-large vacancies occurring between elections are filled by appointment by the Budget Committee. One Selectman is appointed by the

Select Board to sit as a member for a one-year term.

The Canaan Budget Committee was established in 1943. The current Committee includes nine members-at-large elected for three year terms. Terms are staggered so that 1/3 of the terms expire each year. Member-at-large vacancies occurring between elections are filled by appointment by the Budget Committee. One Selectman is appointed by the

Select Board to sit as a member for a one-year term.

The Role of the Budget Committee:

- Receives the recommendations of the Department Heads for the next annual budget

- Reviews and considers the recommendations of the Capital Improvements Program Committee

- Receives the recommendations of the Board of Selectmen for the next annual budget

- Requests and reviews any additional information for the budget preparation

- Prepares the annual budget for submission to voters

The basic responsibility of the Budget Committee is to prepare the annual budget for submission to the annual town meeting of the voters. A major source of information used in development of the budget is the governing body's (Select Board) recommendations to the Budget Committee. This is required to be submitted to the Budget Committee, "together with all information necessary for the preparation of the annual budget, including each purpose for which an appropriation is sought and each item of anticipated revenue, at such time as the budget committee shall fix..." The Budget Committee also confers with the governing body and with other officers, department heads and other officials, relative to estimated costs, anticipated revenues, and services performed. All such officers and other persons are required to furnish such pertinent information to the Budget Committee. The Budget Committee is required to conduct a public hearing to allow the public to provide input to the budget recommendation.

The final budget is in a detailed format with more than 300 individual lines. The data from this format is consolidated in a form specified by the NH Department of Revenue Administration. That form is called an MS-737. The MS-737 also includes the anticipated revenue for the coming year. Each of the expenditure categories on the form should indicate the amount that was approved by the budget committee for the coming year. The budget committee also reviews the revenue budget and indicates the amount that was approved by the budget committee. The finished form should be reviewed by the budget committtee and, to be legal, must be signed by a majority of the budget committee. Once the MS-737 is signed, it must be posted with the annual town meeting warrant.

Specific requirements of Municipal Budget Law are provided below. Chapter 32, Municipal Budget Law, establishes duties and responsibilities of the budget committee. The complete text of these RSA's can be found online by clicking here.

RSA 32:1-13 apply to all towns, which adopt their budgets at an annual town meeting. RSA 32:14-23 apply to towns with budget committees

RSA 32:1, Statement of Purpose. states, in part: "...The budget committee, in those municipalities which establish one, is intended to have budgetary authority analogous to that of a legislative appropriations committee...."RSA 32:16, Duties and Authority of the Budget Committee. defines the specific duties and authority of the budget committee as follows: "In any town which has adopted the provisions of this subdivision, the budget committee shall have the following duties and responsibilities:

- To prepare the budget as provided in RSA 32:5, and if authorized under RSA 40:14-b, a default budget under RSA 40:13, IX(b) for submission to each annual or special meeting of the voters of the municipality, and, if the municipality is a town, the budgets of any school district or village district wholly within the town, unless the warrant for such meeting does not propose any appropriation.

- To confer with the governing body or bodies and with other officers, department heads and other officials, relative to estimated costs, revenues anticipated, and services performed to the extent deemed necessary by the budget committee. It shall be the duty of all such officers and other persons to furnish such pertinent information to the budget committee.

- To conduct the public hearings required under RSA 32:5, I.

- To forward copies of the final budgets to the clerk or clerks, as required by RSA 32:5, VI, and, in addition, to deliver 2 copies of such budgets and recommendations upon special warrant articles to the respective governing body or bodies at least 20 days before the date set for the annual or special meeting, to be posted with the warrant.

Input to assist the budget committee in developing the budget is provided by other government elements in accordance with two other RSA's:

RSA 32:22, Review of Expenditures. states: "Upon request by the budget committee, the governing body of the town or district, or the town manager or other administrative official, shall forthwith submit to the budget committee a comparative statement of all appropriations and all expenditures by them made in such detail as the budget committee may require. The budget committee shall meet periodically to review such statements. The provisions of this section shall not be construed to mean that the budget committee, or any member of the committee, shall have any authority to dispute or challenge the discretion of other officials over current town or district expenditures, except as provided in RSA 32:23."

RSA 32:17, Duties of Governing Body and Other Officials. states: "The governing bodies of municipalities adopting this subdivision, or of districts which are wholly within towns adopting this subdivision, shall review the statements submitted to them under RSA 32:4 and shall submit their own recommendations to the budget committee, together with all information necessary for the preparation of the annual budget, including each purpose for which an appropriation is sought and each item of anticipated revenue, at such time as the budget committee shall fix."

Rev 1707.10 Form MS-737, Budget of a Town with a Municipal Budget Committee. (a) Form MS-737, budget of a town with a municipal budget committee, shall be used by the budget committee of the towns operating under the provisions of RSA 32:14 through RSA 32:24 to prepare and submit to the governing body, for posting with the town warrant, the budget committee’s budget, showing recommended amounts and not recommended amounts, for the annual meeting, pursuant to RSA 32:5 and RSA 32:16. (b) Form MS-737 shall be completed in accordance with the uniform chart of accounts. (c) Form MS-737 shall contain the date it was posted with the warrant and the signatures of at least a majority of the Budget Committee.

Click to view the

Proposed 2021 Expense Budget

Proposed 2021 Revenue Budget

Default Budget

MS-737 for 2021

***********

Approved 2020 Operating BudgetApproved 2020 Revenue Budget

2020 MS-737

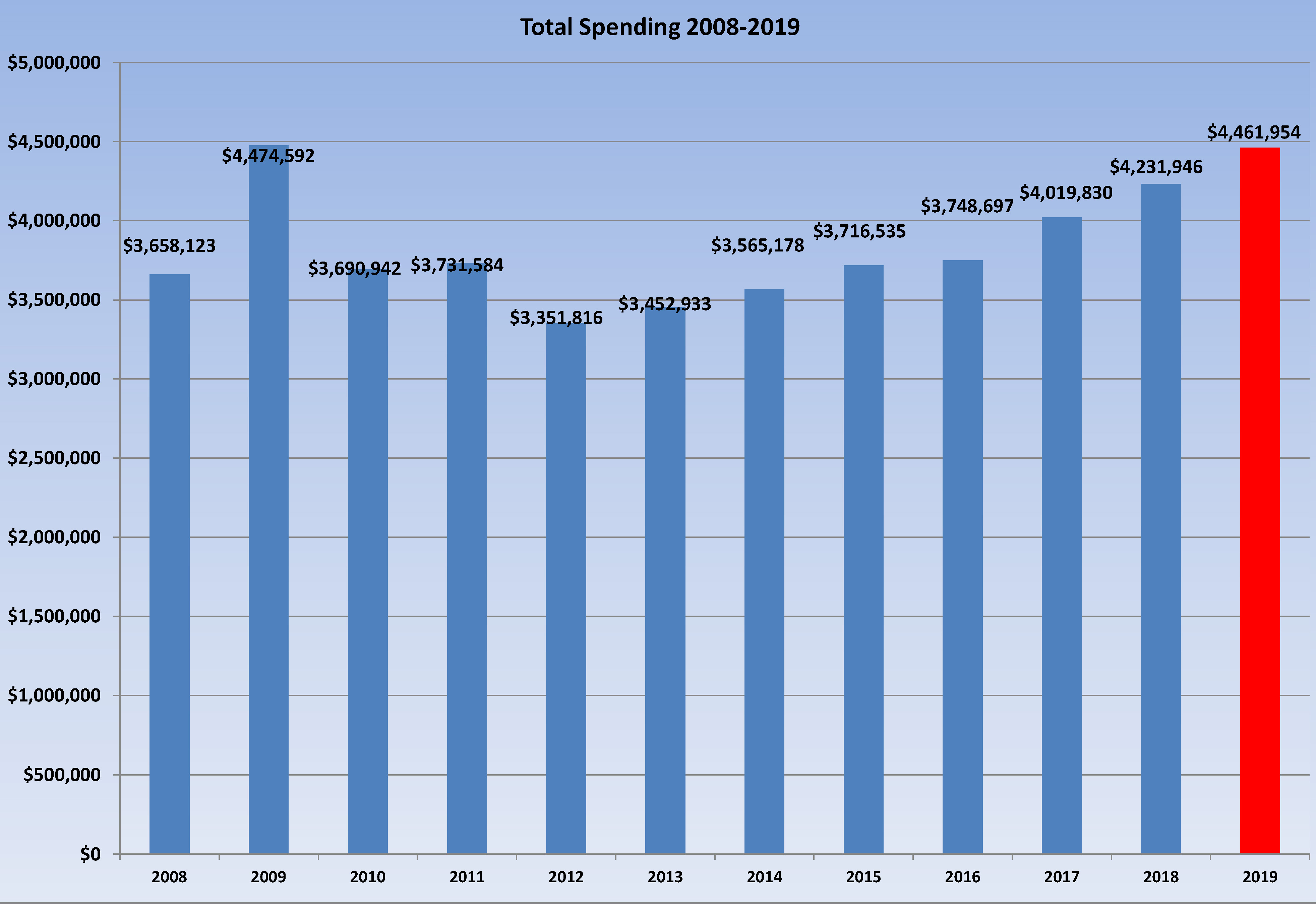

Graph showing the amount budgeted for town expenses over time:

Click to view PDF.

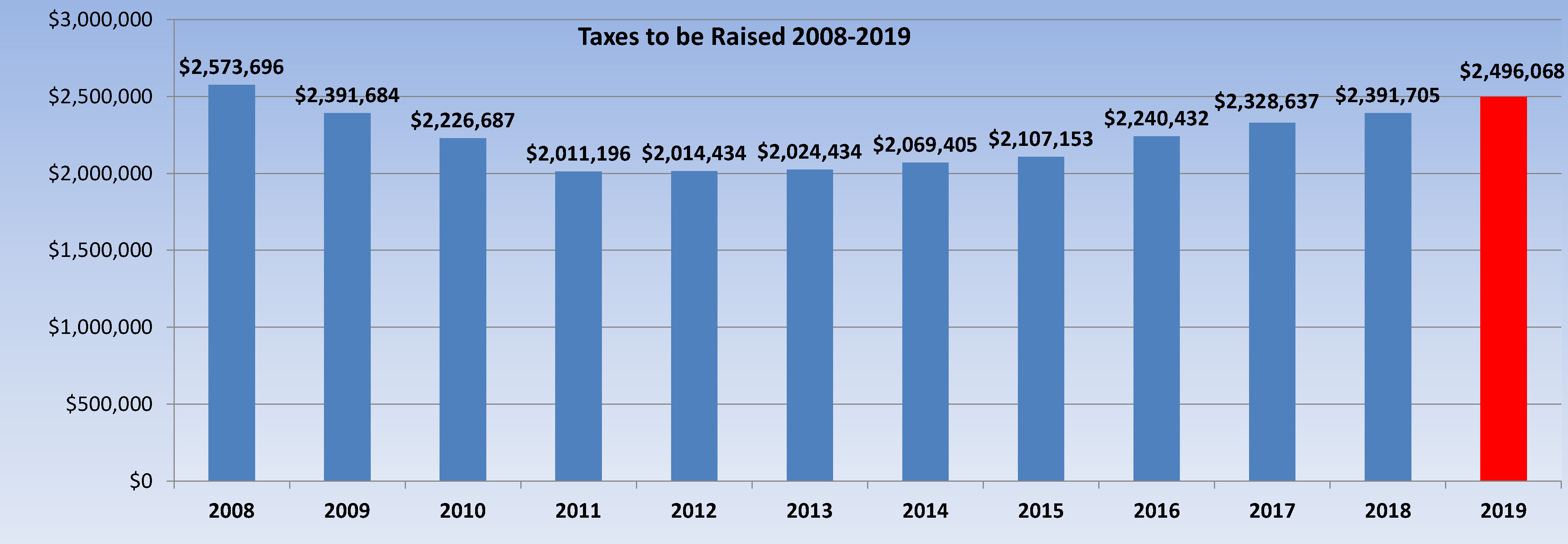

Graph showing the actual taxes raised by year.

Click to view PDF.

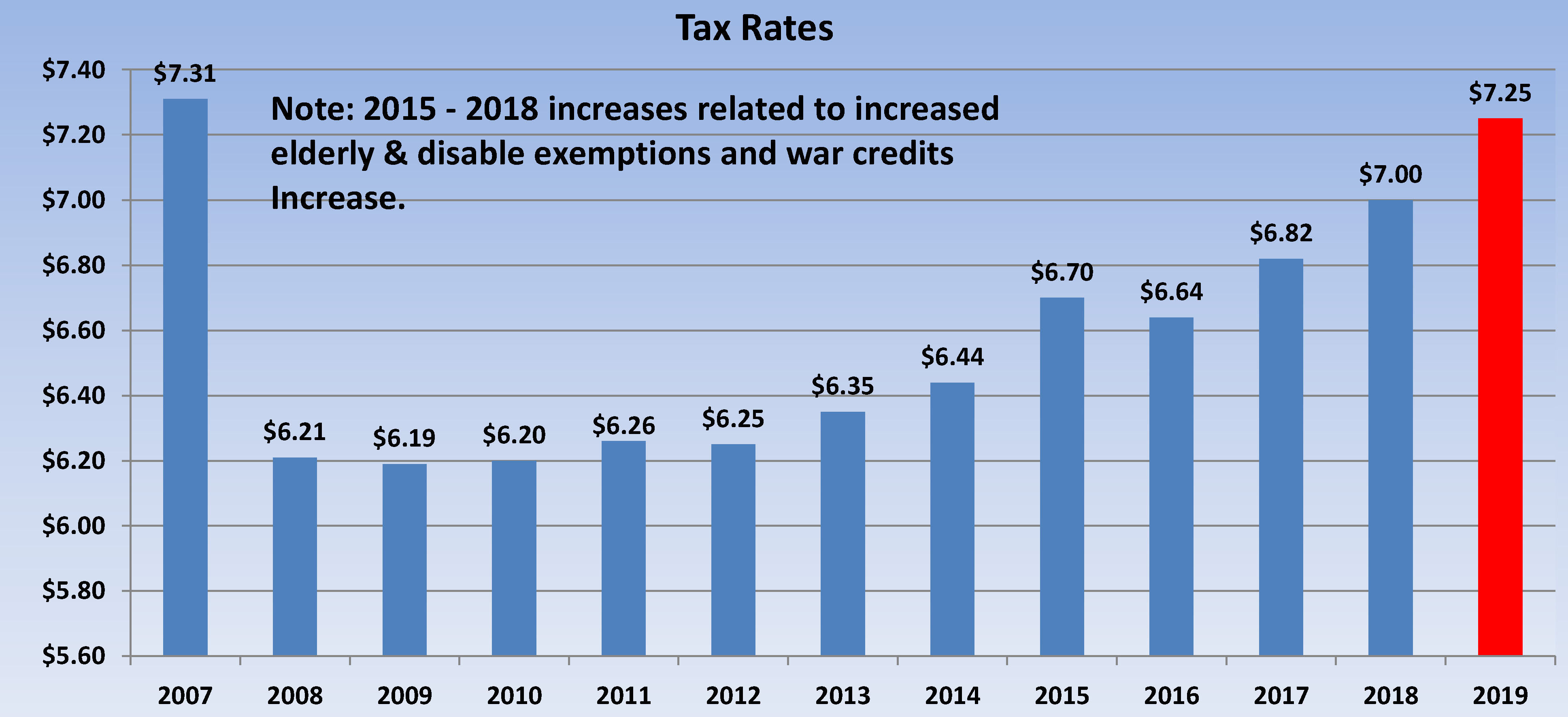

Graph showing the town tax rates over time.

Click to view PDF.

|

|

|

|

|